Finest IRA accountsBest on the internet brokers for tradingBest on the web brokers for beginnersBest robo-advisorsBest choices buying and selling brokers and platformsBest trading platforms for working day buying and selling

HELOC A HELOC is a variable-level line of credit that lets you borrow cash to get a set period of time and repay them afterwards.

For the duration of this method, you will have to post to a tough credit rating pull, which could briefly reduce your credit history score by a handful of points.

We’ll review lenders you might want to take into consideration and information you through the whole process of applying for just a loan.

Car insurance policies guideAuto insurance policy ratesBest auto insurance policy companiesCheapest auto insurancePolicies and coverageAuto insurance policies opinions

While You should utilize personal loans for nearly any goal, some lenders will offer greater prices and conditions for some predicaments than Other individuals.

When acquiring a preapproval, lenders will Examine your credit score together with other components of your finances to determine Everything you can find the money for. If you do not previously determine what your credit history rating is, It is really a smart idea to Test it all by yourself prior to speaking to a lender.

Info Much more data At Bankrate we attempt to assist you make smarter money conclusions. When we adhere to rigorous editorial integrity , this publish may comprise references to merchandise from our companions. Here is a proof for a way website we earn a living .

An unsecured loan does not involve collateral, rendering it a safer option, especially if you have got fantastic credit rating and might qualify for the very best fascination costs.

Style of loan: There are 2 frequent types of non-public loans: unsecured and secured. With an unsecured loan, you gained’t have to have to provide lenders any beneficial collateral.

The principal is the overall amount of money being borrowed. You sometimes obtain this income as being a lump sum after which you can start off spending it back again on a every month foundation.

Amortization program: A desk demonstrating how Just about every regular monthly payment is distributed in between principal and interest.

The Bankrate loan payment calculator breaks down your principal equilibrium by month and applies the desire price you offer. For the reason that this is a simple loan payment calculator, we cover amortization powering the scenes.

Which has a 750 credit score, you’re in placement to acquire several of the most competitive charges that lenders can supply (so long as you satisfy their other underwriting requirements).

Spencer Elden Then & Now!

Spencer Elden Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Anthony Michael Hall Then & Now!

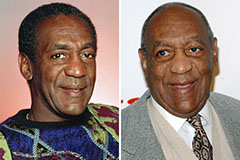

Anthony Michael Hall Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!